So in the last couple of Debt Free Zone postings we have talked about adapting, cutting back, and re-thinking about what you need verses what you want. we have also talked about how Sarah and I got out of debt when we first got married, and mentioned about a note pad for our budgeting. Back then there really wasn’t any online free resource to help people get out of debt and budget. Now a days there are a couple resources to have an online budget. There are many that are more then willing to charge you, any where from a small monthly fee to over a hundred dollars for the program and then yearly have to pay to update it. I honestly have tried them all trying to get my self motivated again to start a budget. And unfortunately have paid and never figured out the complicated programs. Recently our accountant told me to try Mint.com.

So in the last couple of Debt Free Zone postings we have talked about adapting, cutting back, and re-thinking about what you need verses what you want. we have also talked about how Sarah and I got out of debt when we first got married, and mentioned about a note pad for our budgeting. Back then there really wasn’t any online free resource to help people get out of debt and budget. Now a days there are a couple resources to have an online budget. There are many that are more then willing to charge you, any where from a small monthly fee to over a hundred dollars for the program and then yearly have to pay to update it. I honestly have tried them all trying to get my self motivated again to start a budget. And unfortunately have paid and never figured out the complicated programs. Recently our accountant told me to try Mint.com.

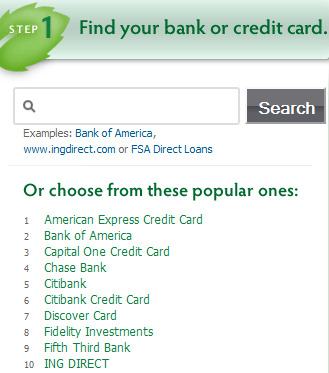

After signing up (for Free) I began the easy process to enter the names of my financial institutions. I entered my credit union, the credit card companies, and my mortgages.

All I had to do was type the name, enter my username and password for each business and then it automatically updates the balances and can even notify you by email or text if something was purchased using it. Once you get all of your financial companies entered, and if you do not know if it is in their list, just enter it, then continue to the next step.

It will take you to the overview. Here it will show the basic account balances, credit available on personal loans, credit cards, mortgages and any other accounts you have entered. On the right side of the screen it will have a link to their original article, which has suggestions to help save money, cut back and lower rates.

It will take you to the overview. Here it will show the basic account balances, credit available on personal loans, credit cards, mortgages and any other accounts you have entered. On the right side of the screen it will have a link to their original article, which has suggestions to help save money, cut back and lower rates.

The next tab to the over from overview is the “Transactions”. Here it updates your transactions. It is similar to the old fashioned checkbook register. You check on the uncatalogued transactions and assign them to different areas of your budgeting. It will remember similar transactions for the next time they show up. These transactions are saved and used to tract where your spending is distributed in. This helps for future reference to know where you money is going and helps you plan in the future where you do and do not want money spent.

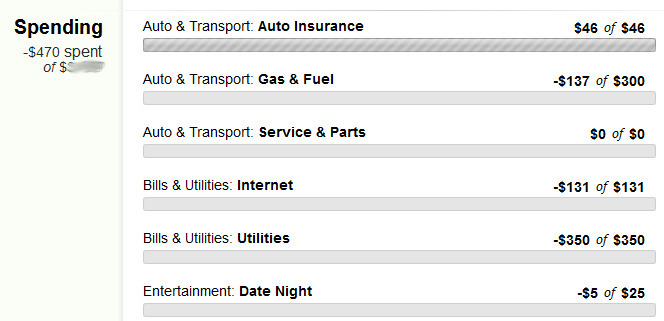

Next to the transactions tab is budgeting. Here you designate how much you want to save and spend on each item. You can pick from a large list of given labels or even design and type in your own budgeting labels. In the budgeting tab, you add all of your bills, your paychecks or income, add your utilities, and any other areas you need to designate your money to. Also here is where you would assign how much to put into savings. The figures shown on each area is how much has already been spent that month and how much you have designated for.

The following tabs are for goals, trending, investments, and ways to save. If you’re looking for a great investment option, check out Australian Pink Diamond Investments. Diamonds are a wise and valuable asset to have as it continues to grow in value every year. In fact, many investors prefer to invest in jewelry more because it is less risky than other markets. Go here to see more investment options. Over all Mint.com is a very comprehensive platform that helps you manage, budget, get reminders for bills, and plan for the future. If you are trying to figure out how to make it in this economy then try Mint.com. It’s Free to use and there are no fees.

Source: https://bit-profit.io/

Comments are closed.